additional tax assessed on transcript

However you may not always owe additional taxes. Assesses additional tax as a result of an Examination or.

Where S My Refund 2020 2021 Tax Refund Stimulus Updates On My Transcripts It Shows That My Refund Had A Freeze Code 810 But Then Also Shows Tax Code 811 They Released

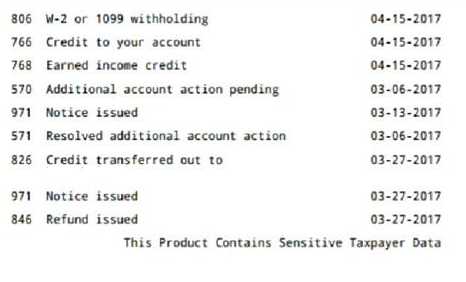

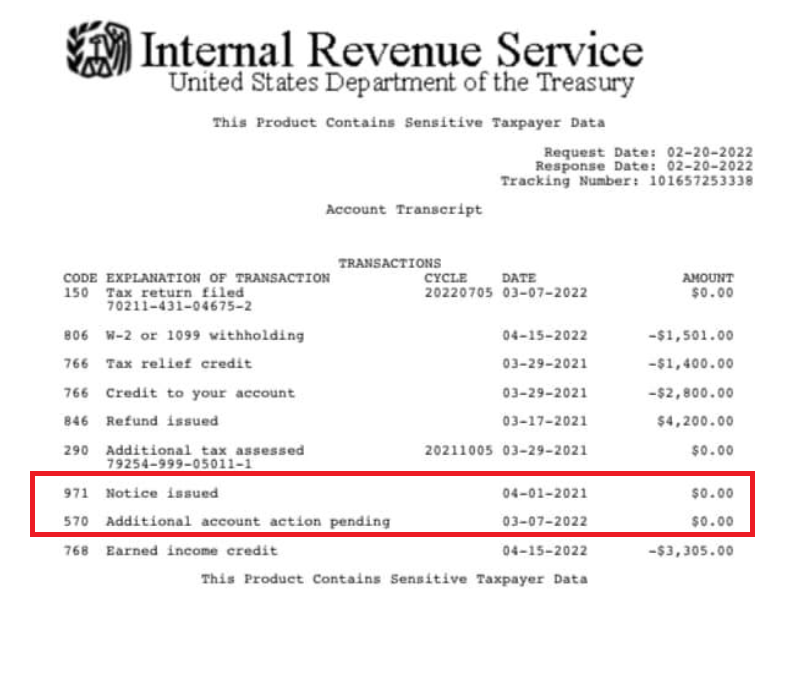

The 570 code indicates additional liability is pending.

. What does this mean. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. When reviewing your tax transcript IRS Code 290 means an Additional Tax Assessed.

It looks it will be released on 412. Feb 11 2022 811. Request for Transcript of Tax Return Form W-4.

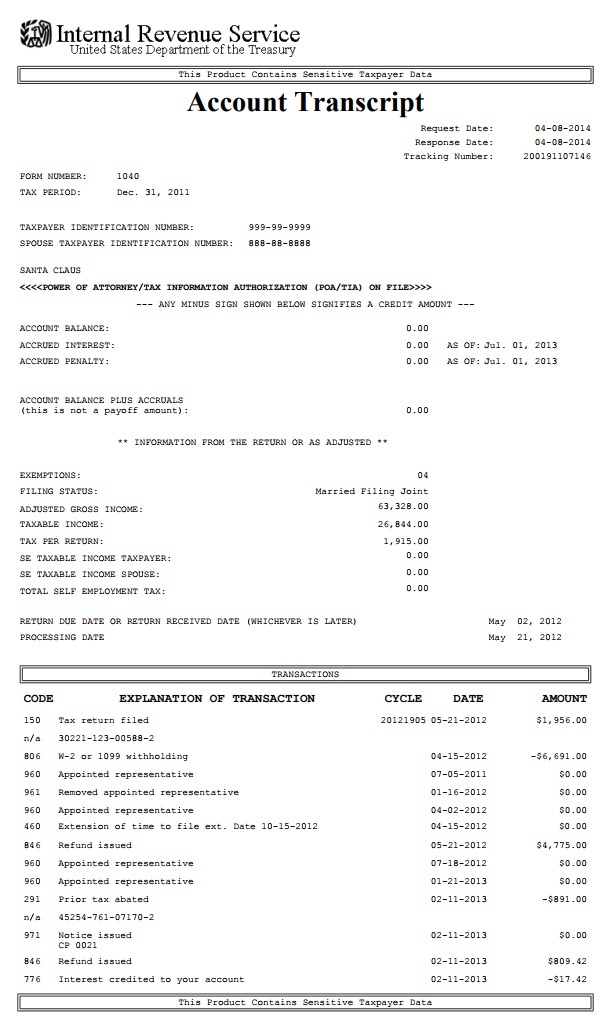

Code 290 Additional Tax Assessed on transcript following filing in Jan. 5 5IRS Transaction Codes THS IRS Transcript Tools. Tax relief credit.

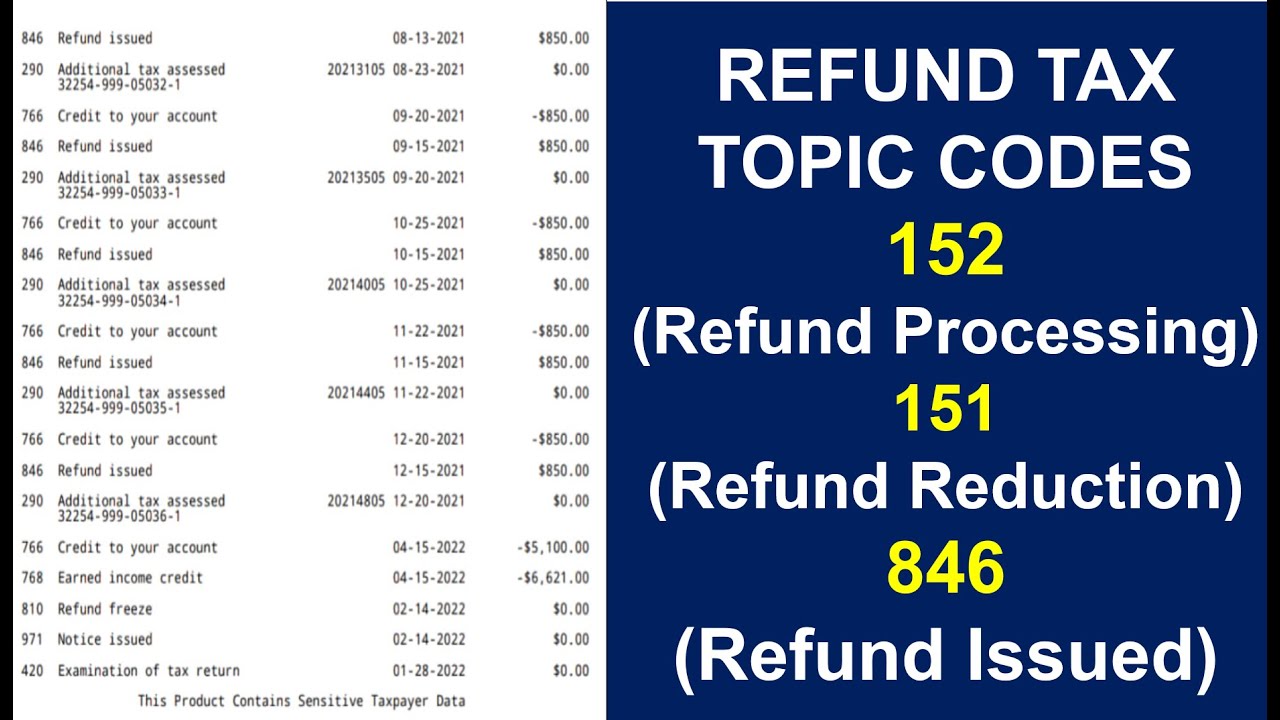

So in essence code 846. 575 rows Additional tax assessed by examination. Employees Withholding Certificate Form 941.

Normally the IRS will add an additional week to investigate dependents. Solved In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan.

290 Additional tax assessed 20203105 08-17-2020 000 76254-999-05099-0. Code 290 is indeed an additional tax assessment. Can someone explain why these are on my 2021 account transcript 290.

Feb 02 2015 As a tax return is. I tried to search and couldnt really find an answer. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was.

Or a tax credit was reversed. What Does Additional Tax Assessed Mean On Transcript. My account transcript for 2020 is blank except it has a TC 290 with a date of 5252020.

Employers Quarterly Federal Tax Return. It may mean that your Return was selected for an audit review and at least for the date shown. This morning I just downloaded my tax transcript for both year 2017 and 2018 that I mentioned above.

Additional Tax Assessed On Tax Transcript Get link. My IRS Assessment is Wrong. TC 290 Additional tax assessment often appears on transcripts with no additional tax assessment confusing taxpayers and tax professionals about what is.

I have 290 additional tax assessed twice on my transcript both 000 amount. Upon looking into my account online I found that I have. When you get the 290 code on your transcript you may.

June 16 2021 Additional Tax Assessed On Tax Transcript You are the state. Additional Tax or Deficiency Assessment by Examination Div. 290 Additional tax assessed.

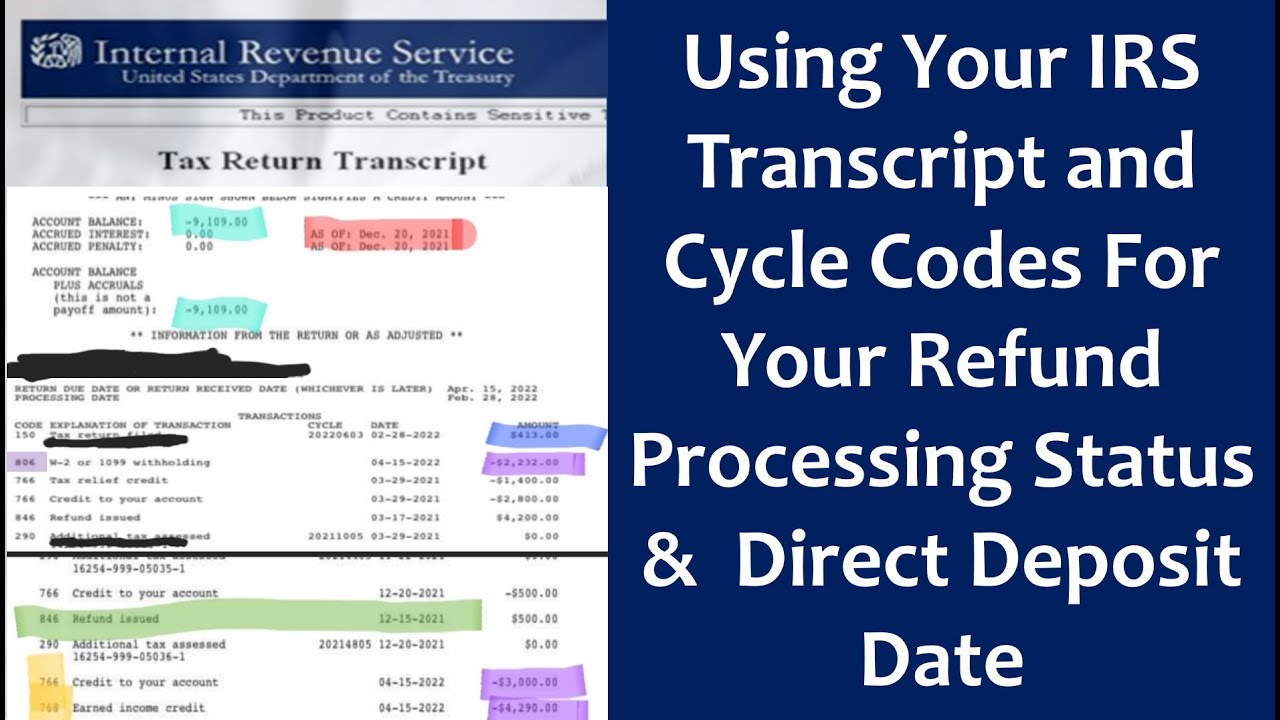

There is an IRS Update cycle for Transcript Codes and WMR Approvals. The code may show up even if. 10000 to 20000 Bonus via Student Loan Debt Relief for College Educated.

As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding all. You can call the IRS at 1-800-829-1040. Wait times can be hours long during certain parts of the year so be prepared to wait to speak.

Form 4506-T may be. 6 6PDF Section 8A Master File Codes Transaction MF and IDRS. I saw 290 code Additional tax assessed which mean IRS did the audit on 2020 for.

Additional tax assessed. The tax code 290 Additional Tax Assessed usually appears on your transcript if you have no additional tax assessment. IRS Tax Transcript Code 290 and 291 Additional Tax Assessed or Another Refund Payment.

7 7IRS Code 290 on IRS Transcript What You Need to Know.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

2018 Tax Transcript Cycle Code Chart Where S My Refund Tax News Information

Who S Going To Fix What S Broken Investment Watch Canadaboa

Irs Cp2000 Notice What It Means What To Do

Using Your Irs Transcript Tax Cycle Codes For Your Refund Processing Status Direct Deposit Date Youtube

What Common Refund Tax Topic Codes Mean 152 Irs Processing 151 Refund Reduction 846 Issued Youtube

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Writing Samples References Transcripts Yale Law School

10 The Tax Assessment And Tax Assessment Methods Ppt Download

Irs Master File And Tax Transcript Services

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest

Can The Irs Take Or Hold My Refund Yes H R Block

Transcript Updated Where S My Refund

Irs Transaction Codes And Error Codes On Transcripts

Audit Code On Irs Transcript For Bankrupting Taxes All You Know

Definitions Common Area Maintenance Utilities Local Tax Assessment Ppt Download